The Future of Drone Insurance: Protection Against Aerial Risks

Airports grounded. Energy generation facilities disrupted. Data centers surveilled from above. The threat no longer comes through firewalls — it comes from the sky.

As drones evolve from hobby devices into advanced reconnaissance and attack tools, they’re creating an entirely new risk category for insurers and enterprises alike. While cyber risk has well-established frameworks, aerial threats are still largely undefined, yet growing impossible to ignore.

The global consensus is that rogue drones will remain a persistent threat because they’re a low-cost and high-impact. But can leaders count on “anti-drone insurance” as a possible remedy? Here’s our take.

Drone Threats are a Global Nuisance

Unauthorized UAV activity has spilled outside of military zones. Airports, oil refineries, power stations, and corporate campuses have been attacked all over the world. The successful 2019 drone assault on Saudi Aramco’s oil facilities was a harbinger. A July 2020 drone crash near a Pennsylvania energy substation and subsequent incidents around New Jersey, New York, Maryland, Minnesota, and Pennsylvania rattled the US operators.

Across the pond, European leaders have been in high alert mode since February 2022 as the rate of unidentified drone flyovers increased with the start of the Russian war against Ukraine. As recently as September 2025, Denmark had to raise the security level of its energy infrastructure to the second-highest tier, following numerous drone sightings over its energy and military infrastructure. Munich Airport had to shut down twice, following suspicious drone traffic.

Consumer drones are as cheap as ever, while jammers and spoofing kits are readily available online. Techniques once confined to conflict zones — like using low-cost drones for surveillance, sabotage, or coordinated swarm attacks — are now accessible to anyone searching well enough.

In contrast, even “minor” incursions can cost millions for the targets. But most businesses don’t yet have effective means to soften the impacts.

The Insurance Market is Catching Up to Drone Threats

Traditional property or liability policies rarely account for drone-borne threats. Traditionally, losses fall into terrorism, war, or sabotage exclusions, leaving businesses uncovered. In response, carriers are trying to ‘plug this gap’ with new offerings.

Terrorism and Political Violence Coverage

In the UK, where rogue drones became a common sight near airports, Air Force bases, industrial and correctional facilities, several drone insurance schemes are emerging.

Pool Re’s terrorism reinsurance product now includes unmanned aircraft within “all-risks” policies for commercial properties in Great Britain. Other major carriers like AIG, Allianz, and Lloyd’s syndicates have also introduced political-violence coverage explicitly listing drone attacks as insured perils. These policies promise to cover property damage and business interruption, even when the physical impact is limited.

War-Risk and Infrastructure Protection Programs

In conflict zones, new “war-risk policies” are emerging with coverage for drone and missile-induced damage. In Ukraine, the government teamed with a local insurer, ARX, to offer up to $50 million in coverage for assets like commercial real estate, energy facilities, and factories.

On the flip side, however, anti-drone insurance policies in high-conflict zones come with raised premiums. Other carriers may be choosing to withdraw their policies altogether. In other words, insurers remain cautious about extending new offers in markets where drone attack risks are high.

Operator and Liability Extensions

At the same time, standard drone pilot insurance policies, required of commercial operators in many markets, now include extended liability clauses. Insurance like AIG now offers optional hijacking and terrorism coverage, protecting pilots from liabilities if their UAVs are spoofed, jammed, or repurposed in an attack.

Building Real Protection: Beyond Drone Insurance Policy Coverage

Insurance alone won’t stop an attack. Effective drone prevention starts with testing and technology. To safeguard your assets, consider this two-step approach:

1. Red-team / blue-team simulations

Running controlled UAV attack simulations exposes weaknesses in airspace monitoring and response protocols. Red teams attempt incursions; blue teams counter them using radar, RF, or AI-powered detection. The result: measurable data for insurance underwriting and internal risk assessments.

At Osiris AI, we run advanced drone defence simulation exercises on 3D digital twins, based on real-world geospatial and OSINT data. A red team of up to five simulates the attack path, and a blue team of the same size and skill works to repel the intrusion.

During an after-action review, we analyze the vulnerabilities and defense gaps. Then, suggest cost-effective asset protection strategies.

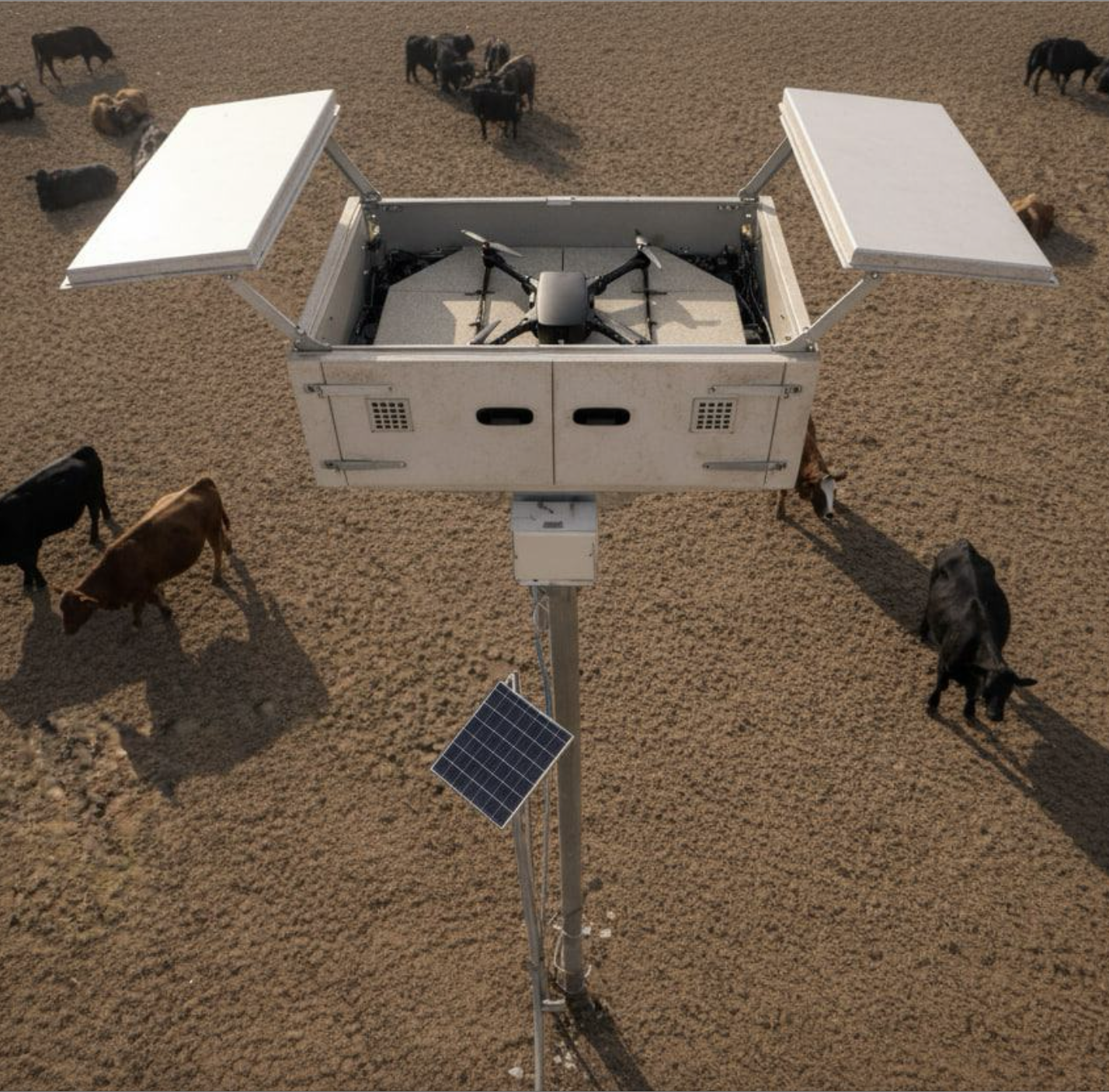

2. Counter-Drone Systems Deployment

Once the vulnerabilities are known, we recommend investing in a tailored anti-drone system. Depending on your asset type, it can feature a mix of RF sensors, jammers, optical trackers, or interception drones.

These safeguards offer baseline protection — and they can also entice insurers to consider extra policy coverage or lower future premiums.

The Bottom Line

Aerial risk is the next frontier of operational security. As the sky becomes as contested as cyberspace, businesses that test, fortify, and insure today will be the ones still operating tomorrow.

The future of drone insurance won’t be reactive—it will be predictive, informed by live threat intelligence, counter-UAV technology, and data-driven underwriting.

Protection, after all, starts before impact.